Employer’s Liability Insurance vs. Workers’ Compensation

From an employer’s perspective, protecting a business and its workers takes more than just following safety rules. It also means carrying the right insurance. That’s where workers’ compensation and employer’s liability insurance play a critical role.

Workers’ compensation covers an injured worker’s medical care and lost wages, no matter who was at fault. Employer’s liability insurance, on the other hand, protects the business if a lawsuit is filed related to a workplace injury.

Although often bundled together, they serve very different purposes. One focuses on supporting employees during recovery, the other shields the business from costly legal battles. Together, they form a safety net that balances the needs of workers and employers alike.

At Fontes Law Group, we know how confusing these terms can feel when a workplace injury happens. This guide explains how both protections work and what they mean for California workers and businesses.

The sections below break down how each type of insurance works, what they cover, and why the distinction matters.

What Is Workers’ Compensation?

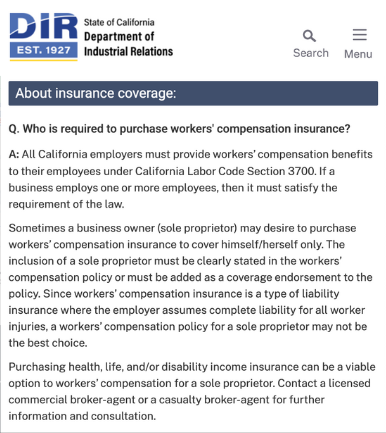

Workers’ compensation is a form of insurance that California law requires for nearly every employer with one or more employees. It is meant to protect workers who are injured or develop an illness related to their job.

The program is designed as a no-fault system, which means that an employee does not have to prove their employer did anything wrong in order to receive benefits. As long as the injury or illness is work-related, benefits are typically available.

These benefits can include:

- Medical treatment for the injury or illness

- Temporary disability payments to replace wages while recovering

- Permanent disability benefits if the worker cannot fully recover

- Supplemental Job Displacement Benefits (SJDB), including a voucher for retraining or education if the worker cannot return to their previous job

- Death benefits for surviving dependents if the worker passes away from the injury or illness

More details on available benefits are explained by the California Division of Workers’ Compensation.

The goal of workers’ compensation is simple: to make sure injured employees get the care and financial support they need, without the time and expense of going through a lawsuit.

What Is Employer’s Liability Insurance?

Employer’s liability insurance serves a different purpose. Instead of directly protecting the worker, it protects the employer if they are sued over a workplace injury.

This type of coverage helps pay for:

- Legal defense costs if the employer is sued

- Settlements to resolve lawsuits out of court

- Judgments if the employer is found responsible

Here are a few examples where employer’s liability might apply:

Example #1: A worker claims the employer ignored safety standards, causing the injury.

Example #2: A spouse sues for loss of companionship or support after a workplace fatality.

Example #3: An employee alleges retaliation or discrimination connected to a workers’ comp claim.

While workers’ comp provides direct benefits to the injured employee, employer’s liability coverage is there to protect the business from financial ruin if a lawsuit is filed.

Key Differences Between the Two

It’s easy to confuse these two policies since they are often sold together, but they operate in very different ways.

|

Feature |

Workers’ Compensation |

Employer’s Liability Insurance |

|

Who it protects |

Employees |

Employers |

|

Covers |

Medical treatment, lost wages, disability, retraining, death benefits |

Legal defense, settlements, and damages from lawsuits |

|

Fault required? |

No – benefits apply regardless of fault |

Yes – only applies if employer is sued for negligence or misconduct |

|

Required by law? |

Yes, all California employers must carry workers’ comp |

Often included with workers’ comp but not always legally required |

|

Paid to |

Injured employees or their families |

Lawyers, courts, or claimants suing the employer |

Why It Matters for Workers

For most injured employees, the workers’ compensation system will be the main source of benefits. That means medical bills, partial wage replacement, and rehabilitation costs are covered through the employer’s insurance.

But in certain cases, employer’s liability insurance becomes relevant. These situations include:

Serious employer misconduct

If an employer’s actions rise to gross negligence or willful misconduct, a worker may have the right to pursue a lawsuit.

Third party claims

If another party (like a contractor, equipment manufacturer, or vendor) played a role in the injury, the injured worker may pursue claims outside the workers’ comp system.

Family lawsuits

If a worker dies from a job-related injury, family members may bring claims against the employer beyond the workers’ comp death benefits.

The important takeaway: workers’ compensation is generally the exclusive remedy for injured workers in California. Lawsuits are rare exceptions, but they do happen, and that’s when employer’s liability coverage is triggered.

California’s Legal Framework

California has one of the strictest workers’ compensation systems in the country. State law makes it mandatory for almost all employers to carry coverage (California Labor Code).

Employer’s liability insurance, on the other hand, is not specifically mandated by the state in the same way. Instead, it is often bundled together with workers’ compensation policies that businesses purchase. Its main purpose is to provide extra protection if claims fall outside the boundaries of workers’ comp.

For employees, this means that employer’s liability insurance usually won’t pay them directly. Instead, their path for recovery remains through the workers’ comp system, or through a lawsuit if an exception applies.

How Fontes Law Group Can Help

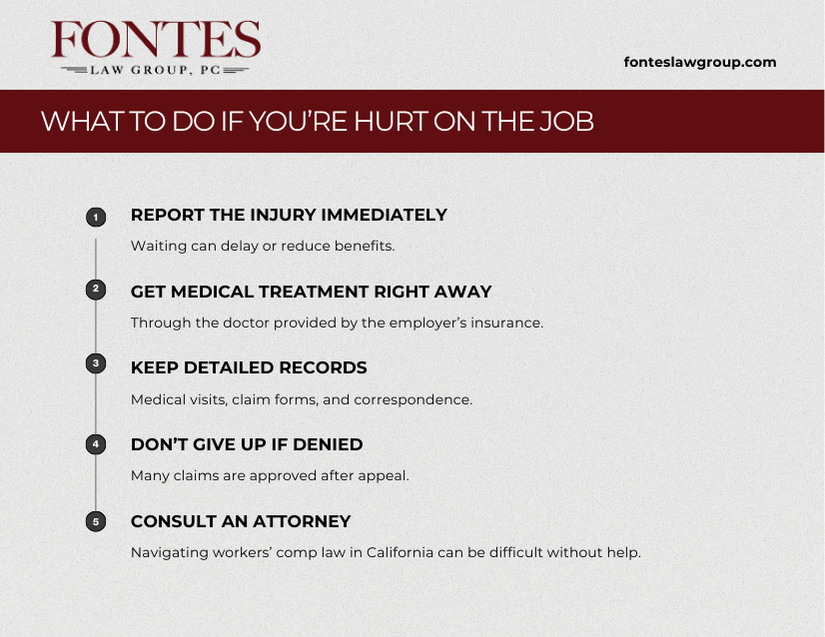

Legal issues involving workplace injuries can feel overwhelming. From filing a claim to dealing with delays or denials, it is not always clear what protections apply or how to enforce them.

At Fontes Law Group, we’ve helped workers across Southern California:

- File strong workers’ compensation claims

- Fight back against delayed or denied benefits

- Secure disability payments while recovering

- Identify when an employer’s conduct opens the door to additional claims

- Navigate the complex overlap of workers’ comp and potential lawsuits

We know how high the stakes are. Medical bills, rent, and family responsibilities don’t stop just because an injury happened. Our job is to fight for fair compensation so injured workers can focus on healing.

With offices in Santa Ana and Riverside, we proudly serve the diverse communities of Southern California in both English and Spanish.

For practical tips, see our guide on what not to do while on workers’ comp in California.

For more guidance, the California Department of Industrial Relations offers a helpful injured worker guide.

Quick Questions and Real Answers

Q: Can an employee sue an employer if they’re already receiving workers’ comp?

Usually no. Workers’ compensation is considered the exclusive remedy for work-related injuries. But if there is intentional harm or extreme negligence, a lawsuit may be possible.

Q: Does employer’s liability insurance give extra benefits to workers?

Not directly. Workers’ comp pays benefits to injured employees, while employer’s liability protects the employer if they’re sued.

Q: What if a third party caused the injury?

In those cases, the worker may have both a workers’ comp claim and a separate personal injury lawsuit against the third party.

Q: Do all businesses carry employer’s liability insurance?

In California, workers’ comp is required by law. Employer’s liability is often included in the same policy, but it is primarily for the employer’s protection.

Final Thoughts

Workers’ compensation and employer’s liability insurance may sound similar, but they are very different. Workers’ comp exists to protect employees, while employer’s liability protects the business. Together, they create a system that supports recovery while limiting legal conflict.

At Fontes Law Group, we believe no worker should have to fight alone for the care and compensation they deserve. Our team is here to guide injured employees through the process, challenge unfair treatment, and pursue every benefit available under the law.

With offices in Santa Ana and Riverside, we proudly serve clients in English and Spanish across Southern California.

If a workplace injury has left questions about benefits or next steps, reach out to Fontes Law Group for a free consultation. We’re ready to help.