Is Lump Sum Workers’ Comp Settlement Taxable?

In most cases, the answer is no. A lump sum workers’ compensation settlement is not taxable under federal or California law.

That means you usually don’t have to worry about the IRS or the state taking a portion of your settlement. Workers’ comp is meant to replace lost wages and cover medical care after a job-related injury, and both the IRS and California treat these benefits differently from regular income.

Still, there are some exceptions where part of your settlement could be taxed, especially if you’re also receiving Social Security Disability benefits or retirement income.

That’s why it’s important to understand how the rules work before making financial decisions about your settlement.

Workers’ Compensation and Taxes: The Basics

The good news: workers’ compensation benefits are generally not taxable. Whether you receive weekly checks or a lump sum settlement, these payments usually will not count as taxable income.

The IRS makes this clear in Publication 525, which explains that benefits paid under a workers’ compensation law for job-related sickness or injury are excluded from income.

California follows the same approach. According to the California Division of Workers’ Compensation, your benefits are not treated like wages, and they do not need to be reported as taxable income.

In simple terms: workers’ comp is not money you earned from working. It is a form of insurance payout that replaces some of your lost wages and covers medical costs.

When Could a Workers’ Comp Settlement Become Taxable?

Although the general rule is that settlements are tax-free, there are a few exceptions where part of your lump sum could be taxed.

1. Social Security Disability Offsets

If you are also receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), your workers’ comp settlement may reduce what you get from Social Security. This is called an “offset.”

When this happens, part of your workers’ comp is effectively treated as Social Security income. Since SSDI is taxable, that portion could become taxable too (SSA.gov).

Example:

- You qualify for $1,200 SSDI per month.

- Because you are also getting workers’ comp, your SSDI drops to $800.

- The $400 difference is treated as if it came from workers’ comp, but it counts as taxable SSDI.

2. Retirement Benefits

If you retire after your injury and start receiving pension or retirement payments, those payments are taxable. The workers’ comp settlement itself remains tax-free, but your retirement income follows standard tax rules.

3. Interest on Settlement

Sometimes settlements include interest for delayed payments. While the workers’ comp portion is not taxed, the interest portion is.

4. Non-Workers’ Comp Claims

If your lump sum includes money outside of workers’ comp, for example from a personal injury lawsuit, different tax rules apply. Some types of damages, like compensation for lost wages outside workers’ comp, may be taxable.

5. Returning to Work

If you are receiving workers’ comp but also go back to work, you will owe taxes on the wages you earn after returning to your job. Workers’ comp itself is not taxed, but regular earnings always are. On top of that, each state has its own tax rules, so depending on where you live, your tax responsibilities may look different. This is why it is smart to talk with a lawyer in your state about how your settlement and wages fit together when tax season comes around.

Lump Sum vs. Weekly Benefits: Any Difference?

Many people wonder if the form of payment changes the tax outcome.

The answer is no.

Whether you receive weekly checks or a one-time lump sum, the tax rules are the same.

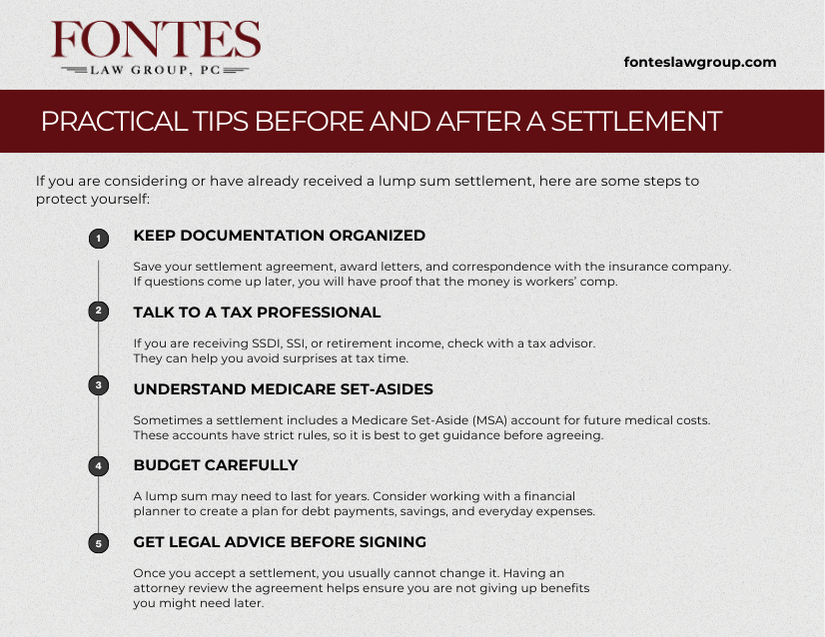

That said, lump sums can have other consequences. They might affect Social Security offsets or eligibility for certain public assistance programs. That is why it is important to think beyond taxes when deciding between a lump sum and ongoing payments.

Why “Tax-Free” Does Not Always Mean Stress-Free

Even though most workers’ comp settlements are not taxed, a lump sum can still affect your finances in other ways:

- Public Assistance Programs: A large payout could affect eligibility for needs-based programs like Medi-Cal or housing assistance.

- Child Support or Spousal Support: Courts may consider settlement money as income when calculating support obligations.

- Budgeting Challenges: Receiving a large amount at once can create pressure to spend quickly, leaving less for future needs.

How Fontes Law Group Supports Injured Workers

At Fontes Law Group, we know how overwhelming these decisions can feel. Injured workers often ask us if their settlement will trigger unexpected taxes or reduce their other benefits.

Here is how we help:

- Clear Explanations: We walk clients through whether a lump sum makes sense for their situation.

- Protecting Benefits: We help minimize SSDI offsets and make sure you do not give up future rights.

- Family Law Guidance: Since we also handle divorce and custody matters, we explain how a settlement could affect child or spousal support.

- Local, Bilingual Service: With offices in Santa Ana and Riverside, our attorneys proudly serve both English and Spanish-speaking families across Southern California.

FAQs About Workers’ Comp Settlements and Taxes

Q: Do I have to report my workers’ comp settlement on my tax return?

Not unless part of it is taxable because of SSDI offsets or interest.

Q: What if I invest my settlement? Are the earnings taxable?

Yes. The settlement itself is not taxed, but any money you make from investing it is taxable.

Q: Can I get both unemployment and workers’ comp?

Not usually. In California, you cannot collect unemployment for the same period you are receiving workers’ comp.

Q: Does workers’ comp cover pain and suffering?

No. Workers’ comp pays for medical care, lost wages, and disability, not pain and suffering. That is why its tax rules are simpler than personal injury settlements.

Q: Should I take a lump sum or weekly payments?

It depends. Lump sums can provide quick financial relief, but they require careful planning. Weekly payments may offer stability over time. An attorney can help you decide.

Bottom Line

The short answer is simple: lump sum workers’ comp settlements are usually not taxable. But if you also receive SSDI, retirement income, or other benefits, part of your settlement could be treated differently.

At Fontes Law Group, we believe no one should face these decisions alone. We have helped countless workers in Southern California protect their settlements, plan for their families, and move forward with peace of mind.

With offices in Santa Ana and Riverside, and bilingual attorneys who serve both English and Spanish-speaking clients, we are proud to stand with our community every step of the way.

If you are facing a settlement offer or have questions about your rights, contact Fontes Law Group today.