How California Calculates Child Support

Understanding the Importance of Child Support

Child support is a critical component in ensuring the well-being and stability of a child’s life after parents separate or divorce. It provides the necessary financial resources for essential needs such as housing, food, education, and healthcare. Navigating the complexities of child support calculations can be overwhelming, especially during an emotionally challenging time.

Fontes Law Group’s Commitment to Families

With years of experience in family law, Fontes Law Group is dedicated to supporting families through compassionate and personalized legal services. Our divorce lawyers understand that every family’s situation is unique, and we are committed to providing expert guidance to help you navigate California’s child support system with confidence.

Overview of Child Support in California

Legal Basis for Child Support

In California, both parents are legally obligated to provide financial support for their child, regardless of marital status. This obligation stems from the principle that every child has the right to receive support from both parents. Child support ensures that the child’s standard of living is maintained and that their needs are adequately met.

Purpose of Child Support

Child support payments are designed to cover a wide range of expenses related to raising a child, including:

- Housing and Utilities: Providing a safe and stable home environment.

- Food and Clothing: Ensuring the child has nutritious meals and appropriate attire.

- Education: Covering school fees, supplies, and extracurricular activities.

- Healthcare: Paying for medical, dental, and vision care.

- Childcare: Facilitating work-related childcare needs.

By contributing to these expenses, child support helps create a balanced and supportive upbringing for the child, even when parents live separately.

The California Child Support Guideline Formula

Introduction to the Guideline

California employs a standardized guideline formula to calculate child support, aiming for fairness and consistency across cases. This formula considers various factors related to both parents’ financial circumstances and the time each parent spends with the child.

Components of the Formula

Parental Income

Gross Income: This includes all income from any source, such as:

- Wages and salaries

- Bonuses and commissions

- Self-employment earnings

- Unemployment benefits

- Disability payments

- Investment and rental income

- Social Security benefits

- Pension and retirement income

Net Disposable Income: Calculated by subtracting certain deductions from the gross income, including:

- Federal and state taxes

- Mandatory union dues

- Health insurance premiums

- Mandatory retirement contributions

Accurately reporting income is crucial, as underreporting or overreporting can significantly impact the support amount.

Time-Share Percentage (Custody)

The “time-share” percentage reflects the amount of time each parent spends with the child. Generally, the more time a parent spends with the child, the lower their child support obligation may be. This factor ensures that both financial support and caregiving responsibilities are fairly allocated.

Adjustments and Deductions

The court may consider additional factors that can adjust the support amount, such as:

- Child Support for Other Children: Existing obligations for children from other relationships.

- Spousal Support Payments: Payments made to or received from a former spouse.

- Extraordinary Expenses: Significant medical costs or educational needs.

The Formula Explained

The basic formula used in California is: CS = K [HN – (H% x TN)]

Where:

- CS = Child Support Amount

- K = Total income available for child support

- HN = High earner’s net monthly disposable income

- H% = Percentage of time the high earner has primary physical responsibility

- TN = Total net monthly disposable income of both parents

Explanation of Variables:

- K (Income Available for Child Support): A factor that represents the proportion of parents’ combined income allocated for child support, adjusted based on the number of children.

- HN (High Earner’s Net Income): The net disposable income of the parent who earns more.

- H% (Time-Share Percentage): The percentage of time the higher-earning parent has physical custody of the child.

- TN (Total Net Income): The combined net disposable income of both parents.

This formula ensures that child support amounts are proportionate to each parent’s income and involvement in the child’s life.

Meet Family Law Lawyer

Catherine J. Navarro

Partner

Factors Influencing Child Support Amounts

Income Considerations

Fluctuating Income

For parents with variable income due to bonuses, commissions, or seasonal work, the court may:

- Average income over a period (e.g., past 12 months).

- Consider earning capacity if a parent is intentionally underemployed.

Non-Wage Income

Income from investments, rental properties, and other sources is included in the calculation to ensure a comprehensive assessment of a parent’s financial situation.

Custody and Visitation Arrangements

The child support amount is influenced by custody arrangements:

- Shared Custody: When parents have equal or near-equal time with the child, the support amount may be adjusted to reflect shared expenses.

- Sole Custody: The non-custodial parent typically pays more in support to the custodial parent, who bears the majority of day-to-day expenses.

Special Circumstances

Additional Children

If a parent is responsible for supporting other children, the court may adjust the support amount to balance obligations fairly across all dependents.

Child’s Special Needs

Children with medical conditions or disabilities may require additional support for therapies, treatments, or specialized education. The court can increase the support amount to accommodate these needs.

High-Income Parents

In cases where parents have a high income, the standard guideline amount may exceed the child’s needs. The court may adjust the amount to a reasonable level that ensures the child’s needs are met without creating an excessive surplus.

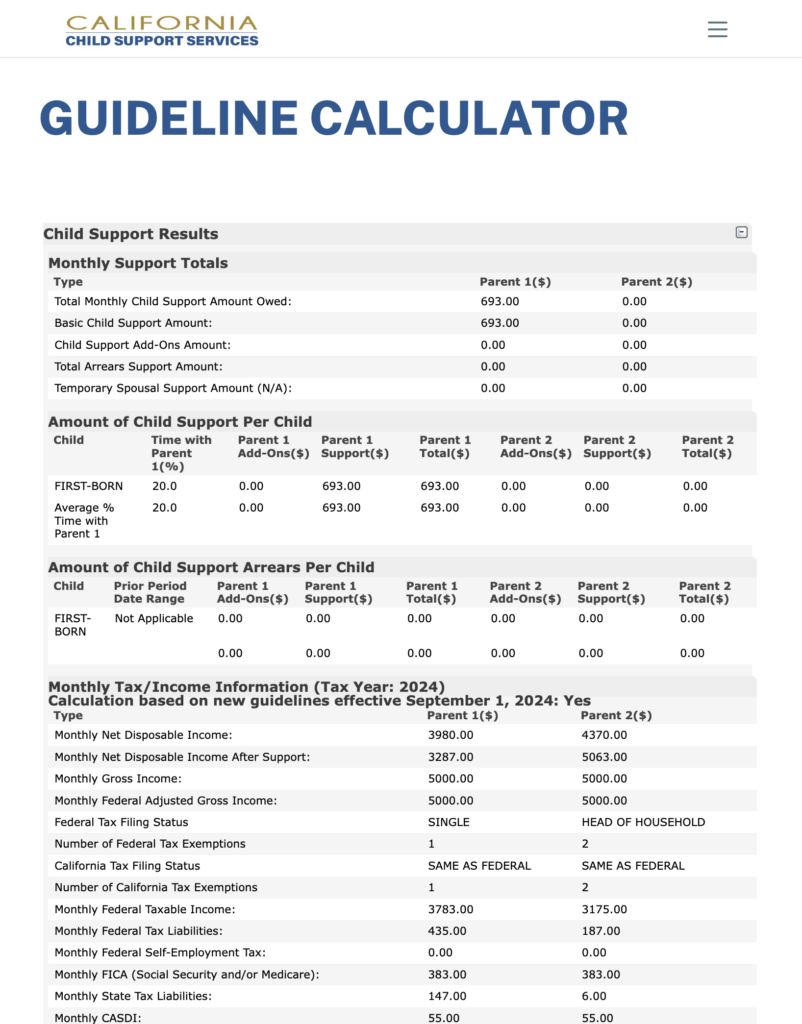

Using the Child Support Calculator

Online Tools

California provides an online child support calculator through the Department of Child Support Services. This tool allows parents to input financial and custody information to estimate support amounts. View the user guide here.

Important Considerations:

- Accuracy of Data: The calculator’s output is only as accurate as the information provided.

- Limitations: The calculator does not account for all nuances of individual cases. It serves as an estimate, not a definitive amount.

- Professional Advice: Consulting with a legal professional ensures that all factors are considered, and calculations are precise.

Gathering Accurate Information

To use the calculator effectively:

- Collect Financial Documents: Pay stubs, tax returns, benefit statements, and expense records.

- Document Custody Arrangements: Keep detailed records of the time each parent spends with the child.

- Update Information Regularly: As circumstances change, revisit the calculations to reflect current situations.

Modifications to Child Support Orders

When Can Support Be Modified?

Modifications to child support orders are permitted when there is a significant change in circumstances, such as:

- Change in Income: Job loss, promotion, demotion, or significant change in earnings.

- Custody Changes: Adjustments in the custody arrangement or time-share percentage.

- New Financial Obligations: Birth of another child or unexpected medical expenses.

- Hardships: Severe health issues or other factors impacting a parent’s ability to pay.

Process of Modification

To modify a child support order:

- File a Request: Submit a formal request for modification to the court.

- Provide Evidence: Present documentation supporting the change in circumstances.

- Serve the Other Parent: Legally notify the other parent of the modification request.

- Attend a Hearing: Both parties may need to appear before a judge to discuss the modification.

Note: It’s crucial to act promptly when circumstances change, as modifications are not retroactive before the filing date.

Enforcement of Child Support Orders

Ensuring Compliance

If a parent fails to comply with a child support order, enforcement measures can be taken:

- Wage Garnishment: Automatic deduction of support payments from the non-compliant parent’s paycheck.

- Property Liens: Claims against the non-paying parent’s property or assets.

- Intercepting Tax Refunds: Seizing state or federal tax refunds to cover overdue support.

- License Suspension: Revocation of driver’s, professional, or recreational licenses.

- Contempt of Court: Legal action that can result in fines or jail time.

Consequences of Non-Payment

Non-payment of child support can lead to serious legal and financial consequences, including:

- Negative Credit Reporting: Overdue payments may be reported to credit agencies.

- Passport Denial: Denial of passport applications or renewals.

- Additional Penalties: Accumulation of interest on unpaid support.

At Fontes Law Group, we assist clients in both enforcing child support orders and defending against unjust enforcement actions, ensuring that legal processes are followed correctly.

Frequently Asked Questions (FAQs)

Q1. What Income is Considered in Calculating Child Support?

Answer: All sources of income are considered, including wages, salaries, bonuses, commissions, self-employment earnings, unemployment benefits, disability payments, investment income, rental income, Social Security benefits, and retirement income. The goal is to capture a comprehensive picture of each parent’s financial situation.

Q2. How Does Shared Custody Affect Child Support?

Answer: In shared custody arrangements, the time-share percentage is a critical factor. The more time a parent spends with the child, the more they directly contribute to daily expenses, which can reduce their child support obligation. However, other factors like income disparities still play a significant role.

Q3. Can Parents Agree to a Different Amount Than the Guideline Suggests?

Answer: Yes, parents can agree to a different amount, but the agreement must be in writing, signed by both parties, and approved by the court. The court will ensure that the agreed amount is in the child’s best interest before approving it.

Q4. Do I Need a Lawyer to Calculate Child Support?

Answer: While not legally required, having a lawyer is highly beneficial. An experienced attorney can ensure that all relevant factors are considered, accurately calculate support amounts, and advocate for a fair arrangement. Legal guidance is especially important in complex situations involving high incomes, special needs, or disputes.

Q5. How Long Does Child Support Last in California?

Answer: Typically, child support continues until the child turns 18 years old. If the child is still a full-time high school student and not self-supporting at 18, support continues until they graduate or turn 19, whichever occurs first. Support may extend beyond these ages if the child has special needs or if parents agree otherwise.